Share post now

Press release

On the side of warmongers and crisis profiteers

17.05.2022, Finance and tax policy

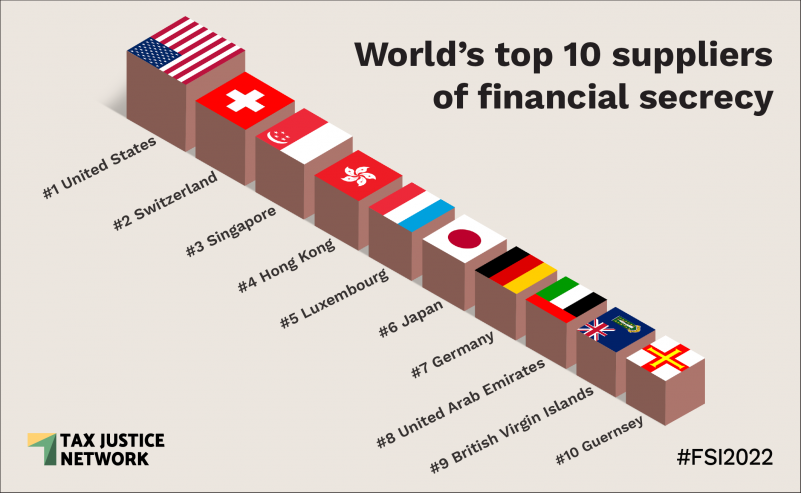

After the USA, Switzerland is the world’s most opaque financial centre. This is clear from the new Financial Secrecy Index of the Tax Justice Network (TJN).

© Tax Justice Network

After the USA, Switzerland is the world’s most opaque financial centre. This is clear from the new Financial Secrecy Index of the Tax Justice Network (TJN). Our country is marking time in the fight against international tax evasion, money laundering and corruption – this is currently proving to be an obstacle in the search for sanctioned funds belonging to Russian oligarchs. Greater transparency is urgently needed.

According to the calculations published today by the TJN, Switzerland is home to one of the financial centres most attractive to tax evaders, money launderers, financiers of terrorism, or corrupt politicians. For not only do Swiss banks manage more foreign assets than anywhere else in the world – currently more than 3,600 billion francs according to the Swiss Bankers Association – but despite all the reforms of the past 10 years, the Swiss financial centre remains one of the world’s least transparent.

As regards the Russian war of aggression in Ukraine, this is problematic for two reasons, says Dominik Gross, Financial Policy Expert at Alliance Sud, Switzerland’s centre of excellence for international cooperation and development policy: “First, Switzerland lacks the laws under which the authorities could undertake an active search for much of the sanctioned assets belonging to Russian oligarchs. TJN studies make this clear.” According to the State Secretariat for Economic Affairs (SECO), just 6.3 billion francs in Russian assets are currently frozen in Switzerland, the banks having again released more than one billion since April. And this even though, according to the Bankers Association, there are some 150-200 billion in Russian assets in Switzerland.

In addition, because Switzerland still undertakes no automatic exchange of information on financial accounts (AEOI) with many developing countries, tax evaders from non-AEOI countries still have virtually nothing to fear with Swiss banks. Gross continues: “They hide money here from the tax authorities in their home countries, where it is urgently needed for coping with the food crisis triggered by the war in Ukraine.”

Parliament must act

Despite the pressing need for action, the Federal Council remains inactive. The National Council and Council of States could soon rectify that, however:

- A cross-party motion in the National Council calls on the Federal Council to bring forward a draft law to ensure greater transparency, so that the true owners of shell companies and beneficiaries of offshore entities are at least known to the authorities.

- Other initiatives by National Councillors request the Federal Council to outline the way it intends to identify and confiscate sanctioned assets, and call for a Swiss Task Force to be created, or for Switzerland to join the international task force that is actively seeking Russian assets.

- A postulate by the Foreign Affairs Committee of the National Council requests the Federal Council to prepare a report setting out its plans for making financial flows in and through Switzerland more transparent.

Further information:

Dominik Gross, Financial Policy Expert at Alliance Sud: +41 78 838 40 79